EU-India Trade Deal: A Geopolitical Shift and What It Means for Global Markets

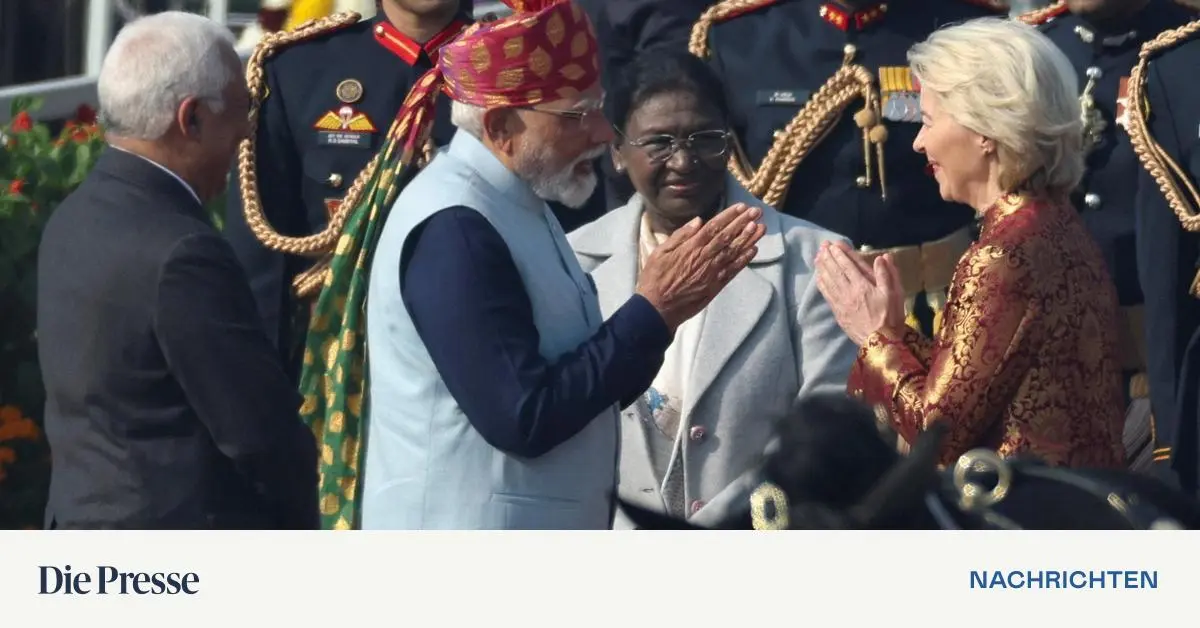

After two decades of negotiations, the European Union and India have reached a political agreement on a landmark free trade deal. Strikingly, the agreement bypasses the contentious issue of agricultural products – a move that signals a pragmatic approach to securing a broader economic partnership. This deal, finalized on World Customs Day, isn’t just about tariffs; it’s a strategic realignment in a world increasingly defined by geopolitical tensions.

The Agricultural Exclusion: A Calculated Risk

The decision to exclude agriculture, at least initially, was crucial to overcoming a major sticking point. European farmers, particularly in countries like France, have long feared increased competition from Indian agricultural products. Norbert Totschnig, Austria’s Agriculture Minister, expressed relief, noting there would be “no concessions for imports of sensitive products like beef or sugar.” This demonstrates a growing trend of prioritizing strategic economic goals over complete liberalization, especially in politically sensitive sectors. The EU is currently experiencing farmer protests, highlighting the sensitivity of this issue. This deal avoids adding fuel to that fire.

A Counterweight to US-China Dominance

The EU-India agreement represents a significant geopolitical statement. As the US and China increasingly compete for global influence, both the EU and India are actively seeking to diversify their economic partnerships. Ignacio García Bercero, a former EU trade negotiator, points out that this deal provides both sides with “additional geopolitical leeway.” This isn’t simply about trade volumes; it’s about creating a more multipolar world order. Consider the recent strengthening of ties between Saudi Arabia and China – a clear indication of nations seeking alternatives to traditional alliances.

India’s Rising Economic Power: A Market to Watch

The timing of this agreement is particularly noteworthy given India’s economic trajectory. Since 2021, India has consistently outpaced China in economic growth, both in terms of GDP and GDP per capita. While China’s per capita GDP remains significantly higher (around $12,500 in 2023 compared to India’s roughly $10,000), the trendline is shifting. This makes India an increasingly attractive market for European businesses. A recent report by the World Bank projects India to become the world’s third-largest economy by 2030.

Did you know? India’s rapidly growing middle class – projected to reach over 600 million by 2030 – represents a massive consumer market for European goods and services.

Automotive Industry: A Key Beneficiary

The automotive sector stands to gain significantly from the deal. India is the world’s third-largest auto market, and the reduction of tariffs from up to 110% to 40% on European vehicles is a game-changer. However, the initial quota of 200,000 combustion engine vehicles per year will likely create competition. BMW, Mercedes-Benz, Volkswagen, Stellantis, and Renault are all poised to benefit. This mirrors a similar trend seen in the EU-Vietnam trade agreement, where automotive exports saw a substantial increase following tariff reductions.

However, electric vehicles (EVs) are excluded from the immediate tariff cuts, a move designed to protect India’s nascent EV industry. This highlights a growing global pattern of strategic protectionism for emerging technologies. The US Inflation Reduction Act, with its EV tax credits, is another example of this trend.

Beyond Autos: Steel, Chemicals, and the CBAM Challenge

The agreement extends beyond automobiles. Europe anticipates increased exports of machinery, chemicals, and plastics. India, in turn, seeks greater access for its steel exports, currently hampered by Chinese overcapacity and US tariffs. While cheaper Indian steel could benefit European manufacturers, it will also create competitive pressure for European steelmakers.

A significant point of contention was India’s demand for exemptions from the EU’s Carbon Border Adjustment Mechanism (CBAM). India argued that applying CBAM to energy-intensive exports like steel and cement would negate the benefits of tariff reductions. This reflects a broader debate about the fairness and impact of carbon border taxes on developing economies. The EU is currently reviewing the implementation of CBAM to address these concerns.

Future Trends and Implications

The EU-India trade deal is likely to spur further regional trade agreements. We can expect to see increased efforts to forge similar partnerships between the EU and other Asian economies, such as Indonesia and Vietnam. The focus will likely remain on strategic sectors and a pragmatic approach to agricultural liberalization.

Furthermore, the deal could accelerate the trend towards “friend-shoring” – the practice of relocating supply chains to trusted partner countries. European companies may increasingly look to India as an alternative to China for manufacturing and sourcing. This is particularly relevant in sectors like pharmaceuticals and electronics.

Pro Tip: Businesses looking to capitalize on the EU-India deal should conduct thorough market research and develop a localized strategy. Understanding Indian regulations, consumer preferences, and cultural nuances is crucial for success.

FAQ

Q: Will this deal lead to lower prices for consumers in Europe?

A: Potentially, yes. Reduced tariffs on imported goods could lead to lower prices, but this will depend on market dynamics and competition.

Q: What about the impact on European farmers?

A: The agreement specifically excludes agricultural products, aiming to protect European farmers from increased competition.

Q: When will the tariff reductions take effect?

A: The agreement needs to be formally ratified by both the EU and India. The timeline for implementation is expected to be within the next year.

Q: Will this deal affect the relationship between the EU and China?

A: The deal is partly a strategic move to diversify economic partnerships and reduce reliance on China, but it doesn’t necessarily signal a breakdown in EU-China relations.

What are your thoughts on the EU-India trade deal? Share your comments below and explore our other articles on global trade and geopolitical trends. Subscribe to our newsletter for the latest insights.