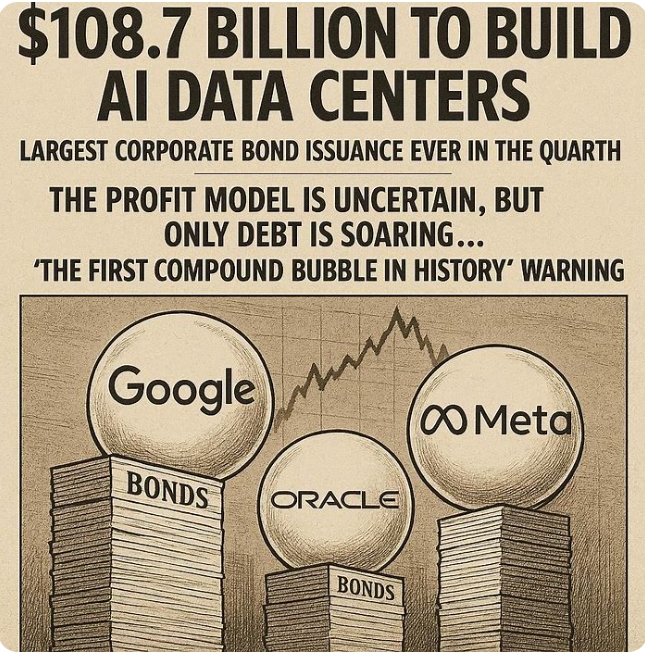

The AI Debt Bomb: Are Tech Giants Building a Bubble?

The relentless pursuit of artificial intelligence dominance is driving tech giants to unprecedented levels of debt. Recent reports reveal a staggering $108.7 billion (approximately $156 trillion Korean Won) in company bonds issued in the fourth quarter alone by companies like Oracle, Google, and Meta – a record-breaking figure. This isn’t just about funding innovation; it’s raising serious concerns about a potential economic bubble, fueled by uncertain returns and massive capital expenditure.

The Scale of the Borrowing

The surge in borrowing is directly linked to the enormous costs of building and powering AI infrastructure. Data centers, in particular, require substantial investment in hardware, energy, and cooling systems. According to data from Moodys Analytics, tech company bond issuance doubled in Q4 compared to the previous quarter, with $15.5 billion issued in the first two weeks of January alone. This trend signals a continued reliance on debt to finance AI ambitions.

Did you know? The energy demands of training a single AI model can be equivalent to the lifetime emissions of five cars.

Why the Debt? The AI Investment Cycle

Companies are pouring money into AI not just for chatbots and virtual assistants, but for the underlying infrastructure that makes these technologies possible. Google, Microsoft, Amazon, and Meta have collectively pledged over $300 billion for AI data centers. This aggressive investment is driven by the belief that AI will unlock significant future revenue streams, but the path to profitability remains unclear.

Venture capitalist Paul Kedrosky succinctly puts it: “The tech industry has suddenly become the biggest player in the corporate debt market.” While these companies have historically enjoyed strong profitability, the sheer scale of AI investment is forcing them to rely on debt to accelerate their plans.

Oracle’s Rollercoaster and Investor Concerns

Oracle provides a stark example of the risks involved. After announcing a $300 billion contract related to its Open AI capabilities, its stock price surged, briefly making founder Larry Ellison the world’s richest person. However, investor enthusiasm waned as concerns grew about the company’s mounting debt. As of January 23rd, Oracle’s stock had plummeted 45% from its September peak. A recent lawsuit filed by the Ohio Carpenters Pension Fund alleges that Oracle failed to disclose the full extent of its debt obligations.

The Shifting Landscape of Corporate Debt

Traditionally, industries like automotive and utilities were the biggest issuers of corporate bonds. However, the AI revolution has dramatically shifted this landscape. The need for massive computing power and energy consumption has propelled tech companies to the forefront of the debt market. This is a significant departure from the 1990s internet boom, where infrastructure costs were comparatively minimal.

Pro Tip: Keep a close eye on the debt-to-equity ratios of major tech companies. A rising ratio can indicate increasing financial risk.

Meta and the Race for AI Supremacy

Among the tech giants, Meta has been the most aggressive borrower to fund its AI data center build-out. The company is locked in a fierce competition with Microsoft, Apple, and Google in the AI assistant space. This competition is driving up costs and increasing the pressure to secure market share.

The Government’s Role: Potential Bailouts?

The escalating costs have even prompted discussions about potential government intervention. OpenAI’s CFO, Sara Friar, suggested that government guarantees or debt backing might be necessary to finance the massive infrastructure requirements. This proposal sparked controversy, raising questions about whether taxpayers should bear the risk of private sector ventures.

While OpenAI later clarified they weren’t actively seeking federal guarantees, the conversation highlights the potential for government involvement in the AI ecosystem. The Trump administration, despite internal concerns, is actively working to remove regulations perceived as hindering innovation.

A Perfect Storm? The Risk of a Complex Bubble

The combination of massive debt, uncertain revenue models, and potential government intervention has led some experts to warn of a complex economic bubble. Paul Kedrosky argues that this is “the first bubble that combines all of these things – real estate, tech, and government policy.”

FAQ: AI Debt and Economic Risk

- What is a company bond? A debt instrument issued by corporations to raise capital from investors.

- Why are tech companies issuing so much debt? To fund the massive investments required for AI infrastructure, including data centers and energy systems.

- Is this a cause for concern? Yes, the rapid accumulation of debt coupled with uncertain AI revenue models poses a risk to the financial system.

- Could the government bail out tech companies? It’s a possibility, but a controversial one, with significant political and economic implications.

Related Reads:

- Moody’s Analytics – For in-depth financial analysis.

- The Washington Post – Original source of the reported data.

What are your thoughts on the AI debt situation? Share your opinions in the comments below! Explore our other articles on artificial intelligence and economic trends to stay informed.