The American LNG Boom: Exporting Stability, Importing Volatility?

For decades, North America’s shale gas abundance acted as a shield against global energy instability, promising affordable bills and a competitive industry. However, a recent analysis by the Institute for Energy Economics and Financial Analysis (IEEFA) reveals a more complex reality: stability exported, and volatility imported. As record volumes of liquefied natural gas (LNG) are shipped to overseas markets, the North American gas ecosystem is becoming increasingly tethered to global price dynamics, potentially impacting consumers.

The Rise of the US as an LNG Superpower

The United States has rapidly ascended to become the world’s leading LNG exporter. From a marginal player in 2016, the US now dominates the market, and North American export capacity is projected to double by 2030, potentially accounting for roughly one-third of global LNG trade. This expansion is largely concentrated along the US Gulf Coast, leveraging prolific gas production from nearby fracking basins and existing infrastructure.

Domestic Costs of Global Ambitions

This aggressive expansion isn’t without consequences for North American consumers. IEEFA’s North American LNG Export Tracker highlights growing tensions as exports increasingly strain domestic supply. In fact, gas exports have already surpassed the total consumption of all residential and commercial buildings in the United States. This dynamic creates a situation where local consumers are competing with European and Asian buyers for the same gas supply, leading to price volatility.

“The LNG export sector is growing very rapidly. It has experienced strong growth in the last decade and will likely continue to grow even more rapidly,” explains Clark Williams Derry, an IEEFA financial analyst. “LNG exports are beginning to create tensions for North American gas consumers.”

Troubled Projects in Canada and Mexico

While the US LNG boom is well underway, projects in Canada and Mexico are facing significant hurdles. Plans to serve Asian markets from the Pacific coasts of both countries have been plagued by skyrocketing costs and project delays. Some Canadian gas pipelines have seen costs balloon from $4 billion to $14.5 billion. These setbacks underscore the challenges of expanding LNG infrastructure outside of the US Gulf Coast.

Europe’s Growing Reliance on US LNG

The shift in European energy policy following the need to reduce reliance on Russian gas has created a significant market for US LNG. Currently, approximately two-thirds of US LNG exports are destined for Europe. This dependence is being solidified through long-term contracts signed in 2025, potentially locking Europe into a long-term relationship with US LNG.

However, this reliance comes at a cost. According to IEEFA analyst Ana Maria Jaller-Makarewicz, US LNG is the most expensive option for European buyers. “We are not buying a cheap fossil fuel; it is the most expensive of all.”

The Fragility of the System

The increasing reliance on a single source of supply – the US – creates vulnerabilities for Europe. If Europe were to reduce its demand for US LNG, the US industry would need to find alternative buyers and establish new supply chains. This highlights the inherent fragility of a system heavily dependent on a single export market.

Did you know? Between 2021 and 2024, the EU reduced its gas demand by 20%. However, US LNG imports quadrupled during the same period, rising from 21 billion cubic meters (bcm) to 81 bcm.

Key European Importers

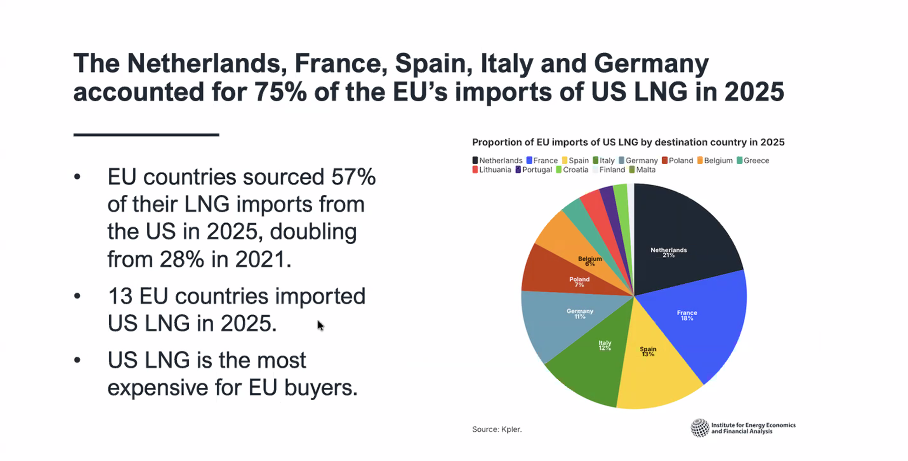

In 2025, five countries accounted for 75% of all LNG imports to the European Union:

- Netherlands: 21%

- France: 18%

- Spain: 13%

- Italy: 12%

- Germany: 11%

FAQ

- What is LNG? Liquefied Natural Gas is natural gas that has been cooled to a liquid state for easier transportation.

- What is the IEEFA? The Institute for Energy Economics and Financial Analysis is a research organization focused on energy and financial markets.

- Is the US LNG export boom impacting domestic gas prices? Yes, increased exports are contributing to price volatility and potentially higher costs for consumers.

- What are the challenges facing LNG projects in Canada and Mexico? These projects are facing significant cost overruns and delays.

Pro Tip: Stay informed about energy market trends by regularly consulting resources like the IEEFA’s North American LNG Export Tracker.

What are your thoughts on the future of LNG? Share your comments below!