Canada’s Trade Pivot: A Sign of Shifting Global Economic Currents?

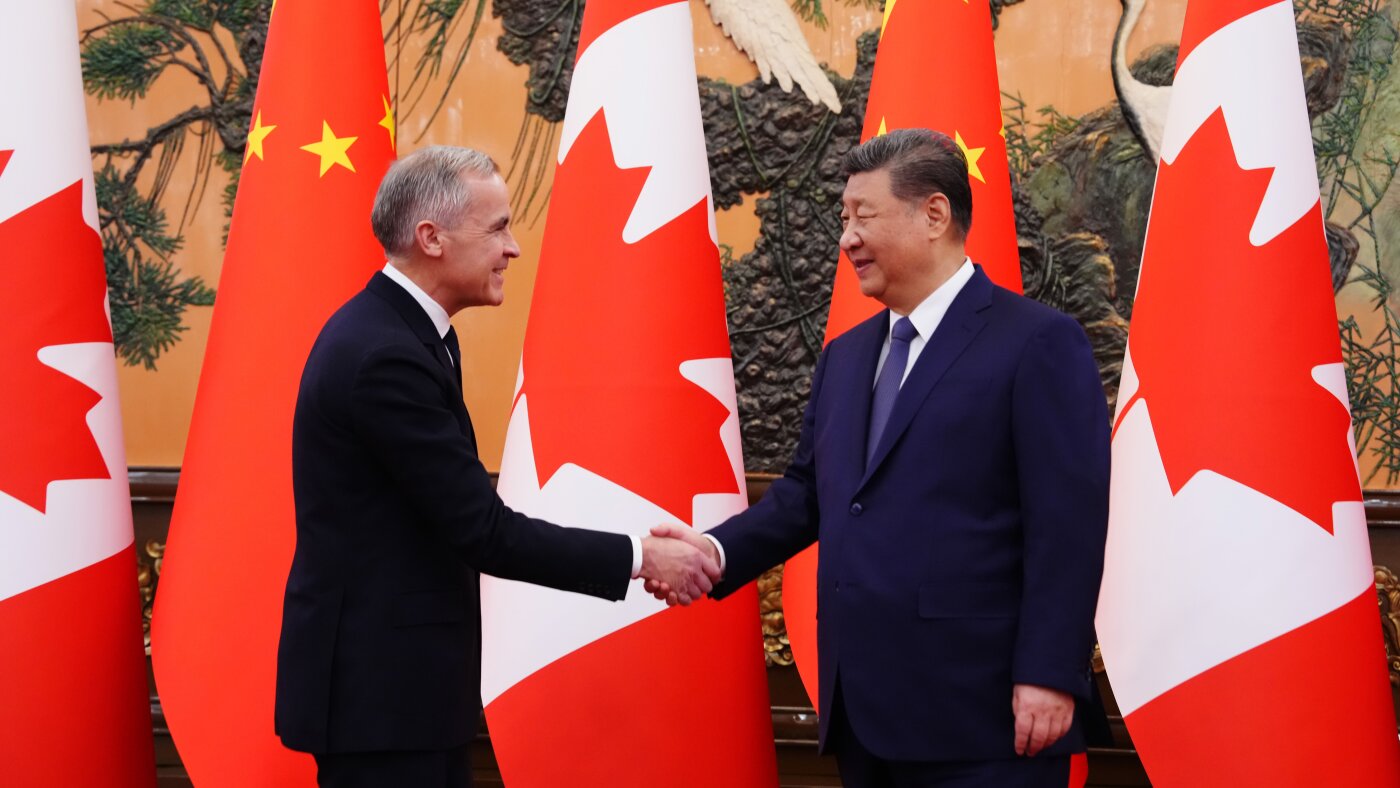

Prime Minister Mark Carney’s recent trip to China and the subsequent agreement to reduce tariffs on Chinese electric vehicles (EVs) in exchange for improved access for Canadian agricultural products marks a significant departure from previous Canadian trade policy. This move, deliberately diverging from the United States’ approach, signals a potential reshaping of global trade dynamics and a growing willingness among nations to forge independent economic paths.

The Rise of Bilateralism and the Decline of Multilateralism

For decades, the prevailing trend in international trade was towards multilateral agreements, epitomized by the World Trade Organization (WTO). However, the WTO has faced increasing challenges, including stalled negotiations and disputes over its dispute resolution mechanism. The Trump administration’s “America First” policies accelerated a shift towards bilateral deals, and this trend appears to be continuing under the Biden administration, albeit with a different tone. Canada’s move with China fits squarely into this pattern.

This isn’t simply about tariffs. It’s about nations reassessing their dependencies and seeking to diversify their trade relationships. The COVID-19 pandemic exposed vulnerabilities in global supply chains, further fueling the desire for greater economic self-reliance. According to a recent report by the Peterson Institute for International Economics, global foreign direct investment (FDI) flows have become increasingly concentrated in bilateral agreements, bypassing traditional multilateral frameworks.

The EV Trade War and Canada’s Strategic Position

The global EV market is a key battleground in the new trade landscape. The U.S. has imposed substantial tariffs on Chinese EVs, citing concerns about national security and unfair trade practices. Europe is also considering similar measures. China, meanwhile, is aggressively expanding its EV production capacity and seeking new markets. Canada’s decision to lower tariffs provides Chinese EV manufacturers with a crucial foothold in North America, while simultaneously securing access for Canadian agricultural exports.

This strategy isn’t without risk. Canadian manufacturers could face increased competition from Chinese EVs. However, Carney’s government appears to be betting that the benefits of improved access to the vast Chinese market outweigh the potential downsides. The initial cap of 49,000 vehicles suggests a cautious approach, allowing Canada to monitor the impact on its domestic auto industry.

Did you know? China is currently the world’s largest EV market, accounting for over 60% of global EV sales in 2023. Source: International Energy Agency

Beyond Trade: Geopolitical Implications

Canada’s independent trade policy also has significant geopolitical implications. By distancing itself from the U.S. on this issue, Canada is signaling its intention to pursue a more independent foreign policy. This could be seen as a response to perceived pressure from the U.S. to align more closely on all issues. The suggestion by the U.S. President that Canada could become America’s 51st state underscores the sensitivity of this issue.

Furthermore, strengthening ties with China could provide Canada with a valuable counterweight to U.S. influence. However, it also carries risks, given China’s human rights record and its increasingly assertive foreign policy. Balancing these competing interests will be a key challenge for the Carney government.

The Future of Canada-U.S. Trade Relations

The long-term impact of this trade pivot on Canada-U.S. relations remains to be seen. While the U.S. remains Canada’s largest trading partner by a significant margin, Carney’s emphasis on diversifying trade relationships suggests a desire to reduce Canada’s economic dependence on the U.S. This could lead to increased friction with Washington, particularly if the U.S. views Canada’s actions as undermining its efforts to contain China’s economic influence.

Pro Tip: Businesses operating in Canada should closely monitor developments in trade policy and assess the potential impact on their operations. Diversifying supply chains and exploring new markets will be crucial for mitigating risk.

FAQ

- What is the main benefit of this trade deal for Canada? Improved access to the Chinese market for Canadian agricultural products, particularly canola seeds.

- Will this affect Canadian consumers? Potentially lower prices for electric vehicles, but also increased competition for domestic automakers.

- Is this a sign of a broader shift in Canadian foreign policy? Yes, it suggests a greater willingness to pursue independent policies and diversify trade relationships.

- What is the US response likely to be? The US may express concerns about Canada undermining its efforts to counter China’s economic influence.

The Canada-China trade agreement is more than just a tariff adjustment; it’s a strategic move that reflects a changing global landscape. As nations grapple with economic uncertainty and geopolitical tensions, we can expect to see more countries pursuing independent trade policies and forging new alliances. This shift towards bilateralism and diversification will likely reshape the future of global trade for years to come.

Reader Question: What role will smaller economies play in this new trade order? Share your thoughts in the comments below!

Explore more insights on global trade and economic policy here. Subscribe to our newsletter for the latest updates and analysis.