Is Rockwell Automation Still a Smart Investment? A Deep Dive into its Valuation

Rockwell Automation (NYSE: ROK) has been a strong performer, with its stock price climbing 42.8% year-to-date and 38.9% over the past year, including a 6.4% jump last month, currently trading around $401.08. But as the stock reaches new heights, investors are rightfully asking: is there still room to run, or has the market already priced in perfection? This analysis explores the company’s valuation, future prospects, and potential risks.

The Rise of Industrial Automation: Why Rockwell is in Focus

Rockwell Automation sits at the heart of a significant, long-term trend: the increasing automation of industry. Companies are investing heavily in robotics, smart factories, and connected industrial systems to boost efficiency, reduce costs, and improve resilience. This isn’t a fleeting fad; it’s a structural shift driven by factors like labor shortages, supply chain disruptions, and the demand for greater customization. For example, a recent report by the International Federation of Robotics showed robot density in manufacturing increased to a record high in 2022, demonstrating the accelerating pace of adoption. This focus on industrial digitalization is precisely why Rockwell has been on investors’ radars.

Valuation Concerns: A Closer Look at the Numbers

Despite the positive outlook, Rockwell’s valuation raises eyebrows. Simply Wall St’s valuation check gives the stock a score of 0 out of 6, signaling potential overvaluation. Let’s break down the analysis using two key approaches.

Discounted Cash Flow (DCF) Analysis: Is the Future Priced In?

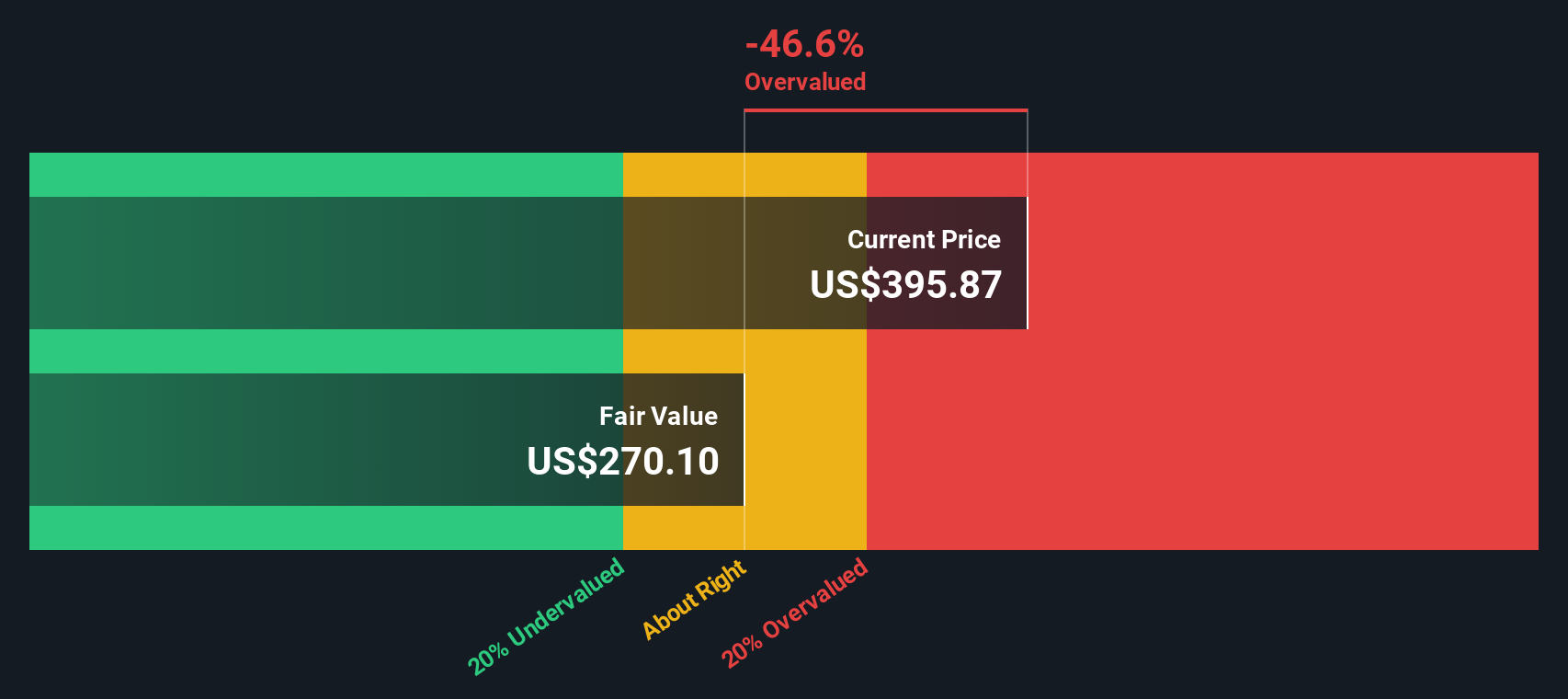

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future cash flows and discounting them back to their present value. Starting with Rockwell’s approximately $1.36 billion in free cash flow last year, and incorporating analyst forecasts, Simply Wall St projects a steady increase in free cash flow, reaching around $1.89 billion by 2029. However, when these projected cash flows are discounted using an appropriate rate of return, the DCF model arrives at a fair value of approximately $270.31 per share.

Compared to the current share price of around $401, the DCF analysis suggests the stock is overvalued by roughly 48.4%. This indicates that a significant portion of future growth is already baked into the price.

Key Takeaway: DCF suggests significant overvaluation.

Looking for undervalued opportunities? Explore 909 undervalued stocks based on cash flows or create your own screener to find better value opportunities.

Price-to-Earnings (P/E) Ratio: How Does Rockwell Stack Up?

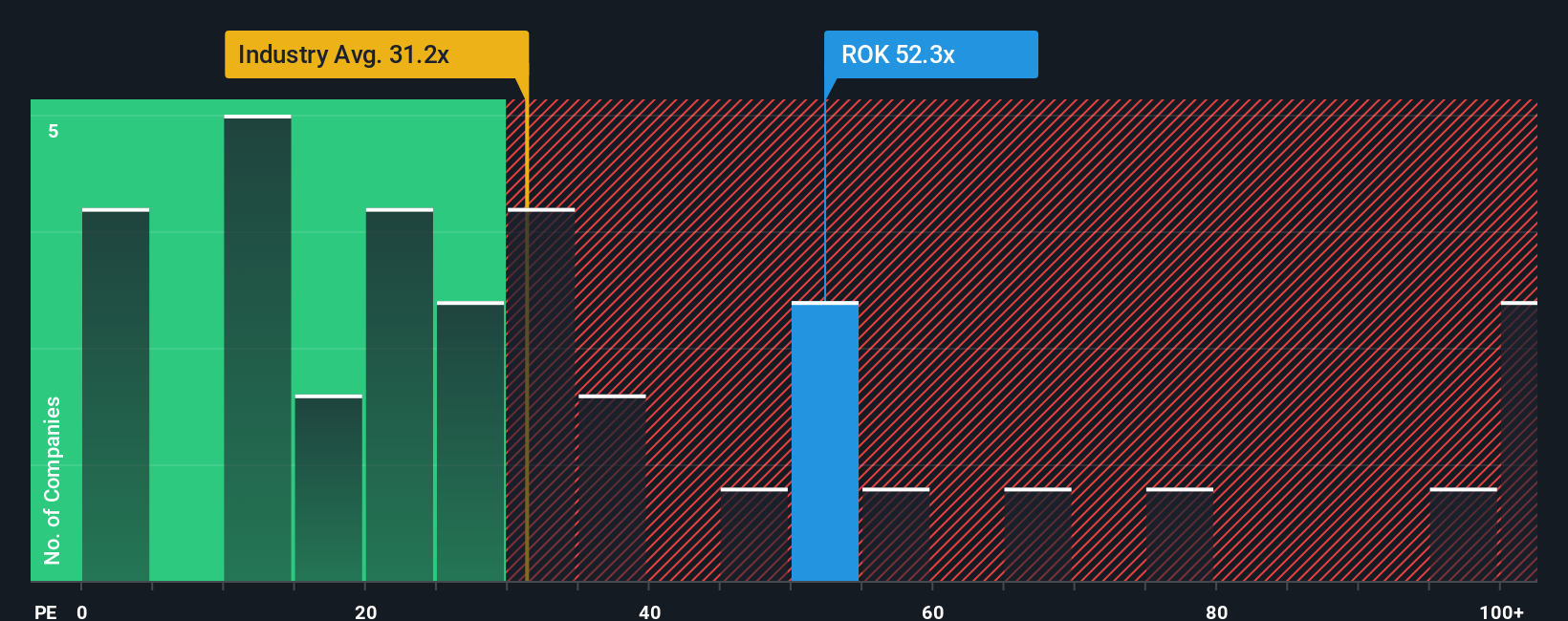

The Price-to-Earnings (P/E) ratio is a useful metric for evaluating profitable, established companies. Rockwell currently trades at a P/E ratio of approximately 51.9x, significantly higher than the industry average of 31.8x for electrical equipment and the broader peer group average of 37.8x. Simply Wall St’s proprietary fair ratio analysis, which considers Rockwell’s growth prospects, profit margins, industry, market capitalization, and risk profile, estimates a fair P/E ratio of 33.8x.

This discrepancy suggests that the market is assigning a premium to Rockwell’s earnings, potentially due to its strong position in a growing market. However, comparing the fair ratio of 33.8x to the actual 51.9x indicates the stock is substantially overvalued from a profitability perspective.

Key Takeaway: P/E ratio confirms overvaluation.

Want to find companies with explosive growth and significant insider ownership? Explore 1457 companies where insiders are making big bets.

Beyond the Numbers: The Power of Narratives

Valuation isn’t just about numbers; it’s about the story behind the numbers. Simply Wall St’s “Narratives” feature allows investors to build and share their own perspectives on a company’s future. Instead of relying solely on financial models, you can create a narrative based on your assumptions about revenue growth, margin expansion, and appropriate valuation multiples.

For Rockwell, a bullish narrative might focus on continued strong demand for automation solutions, rising software margins, and positive revisions to analyst price targets. Conversely, a bearish narrative might highlight potential delays in customer capital expenditures, geopolitical risks, and headwinds from tax policy. Each narrative translates into a fair value estimate, allowing investors to compare their views with the current market price.

Pro Tip: Consider multiple narratives – bullish, base case, and bearish – to get a more comprehensive understanding of the potential range of outcomes.

Join the conversation and see what others are saying about Rockwell Automation: Explore the community narratives.

FAQ: Rockwell Automation – Key Questions Answered

- Is Rockwell Automation a buy, hold, or sell? Based on current valuation metrics, the stock appears overvalued. However, its strong market position and growth prospects warrant continued monitoring.

- What is Rockwell Automation’s fair value? DCF analysis suggests a fair value of around $270.31 per share, significantly below the current price.

- What are the key risks to Rockwell Automation’s stock? Potential risks include economic slowdowns, geopolitical instability, and increased competition.

- What industry does Rockwell Automation operate in? Rockwell Automation operates in the industrial automation and digital transformation space.

Disclaimer: This article is for general informational purposes only and does not constitute financial advice.

Valuation can be complex, but we make it simple.

Get a detailed analysis of Rockwell Automation, including fair value estimates, potential risks, dividend information, insider transactions, and financial health.

Have thoughts on this article? Share your feedback on the content here. Or email [email protected]