The Precious Metals Surge: Beyond a Bubble, a Signal of Deeper Shifts

Silver’s remarkable 75% climb since Chair Powell’s dovish stance at Jackson Hole on August 22nd isn’t an isolated event. It’s a powerful signal, echoing the earlier gold rally and now rippling through platinum and palladium. Markets are exhibiting a clear “contagion” effect – chasing the next available haven. But is this simply a bubble inflating, or a symptom of something more fundamental?

Decoding the ‘Contagion’ in Precious Metals

The current rally isn’t driven by traditional demand. It’s a flight to safety, fueled by anxieties surrounding global debt levels and monetary policy. The charts tell a compelling story. As silver and platinum surge, gold is poised to follow, breaking through previous resistance levels established before the IMF/World Bank meetings in October. This isn’t organic growth; it’s a desperate scramble for assets perceived as holding value in a world of depreciating fiat currencies.

The Dollar Deception: A Weaker Greenback Than Meets the Eye

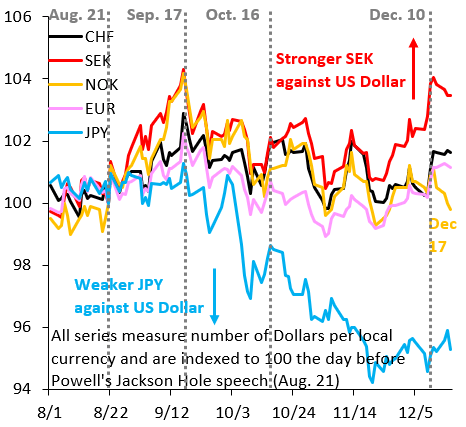

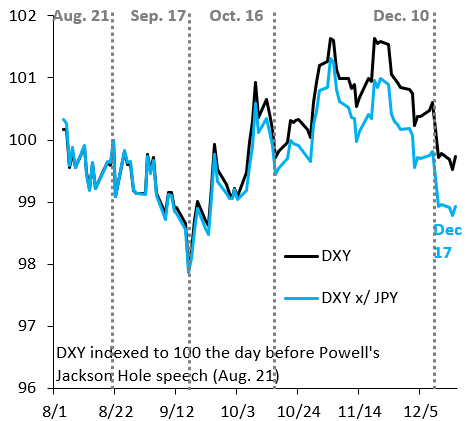

While the trade-weighted Dollar index (DXY) appears stable, a closer look reveals a deceptive picture. The Japanese Yen’s dramatic depreciation is artificially propping up the DXY. Strip out the Yen, and the Dollar’s strength evaporates. This highlights a critical point: the move into precious metals isn’t solely about avoiding the dollar; it’s about escaping a broader environment of currency debasement. Investors are actively seeking alternatives, and precious metals are benefiting from this trend.

Did you know? Japan holds massive amounts of US debt. The Bank of Japan’s interventions to support the Yen often involve selling US Treasuries, indirectly contributing to the “debasement trade.”

The ‘Debasement Trade’ and Safe Haven Flows

The current market dynamic is best described as the “debasement trade.” Central banks worldwide are engaging in monetary policies designed to stimulate economic growth, often through quantitative easing and negative interest rates. This erodes the value of fiat currencies, prompting investors to seek refuge in assets perceived as stores of value. Beyond precious metals, we’re seeing increased demand for safe-haven currencies like the Swiss Franc and Swedish Krona, though their impact is masked by the Yen’s weakness.

What Does This Mean for Investors?

The precious metals rally is likely to continue, driven by the underlying forces of currency debasement and geopolitical uncertainty. However, it’s crucial to approach this market with caution. Bubbles can and do burst. Diversification remains key. Consider allocating a portion of your portfolio to precious metals as a hedge against inflation and currency risk, but avoid overexposure.

Pro Tip: Don’t chase performance. Consider dollar-cost averaging into precious metals to mitigate risk. Look beyond gold and silver to platinum and palladium, which may offer greater upside potential.

Beyond Metals: Other Potential Safe Havens

While precious metals are the most visible beneficiaries of the “debasement trade,” other assets are also attracting attention. Bitcoin and other cryptocurrencies are increasingly viewed as digital gold, offering a decentralized alternative to traditional currencies. Real estate, particularly in stable political jurisdictions, can also serve as a hedge against inflation. However, each asset class carries its own risks and requires careful consideration.

Frequently Asked Questions (FAQ)

- Is this a sustainable rally? The rally is sustainable as long as central banks continue to pursue accommodative monetary policies and geopolitical risks remain elevated.

- What’s driving the Yen’s weakness? The Bank of Japan’s ultra-loose monetary policy and Japan’s large debt burden are key factors.

- Should I sell my dollars? Diversification is key. Don’t put all your eggs in one basket.

- Are platinum and palladium good investments? They offer potential upside but are also subject to supply and demand dynamics specific to their industrial uses.

Reader Question: “I’m worried about getting into precious metals at these high prices. Is it too late?” It’s never easy to time the market. While prices are elevated, the underlying drivers suggest further gains are possible. Consider a long-term perspective and dollar-cost averaging.

Explore our other articles on global economic trends and investment strategies to stay informed. Subscribe to our newsletter for exclusive insights and analysis.