The Billionaire Exodus: Is California Losing Its Luster?

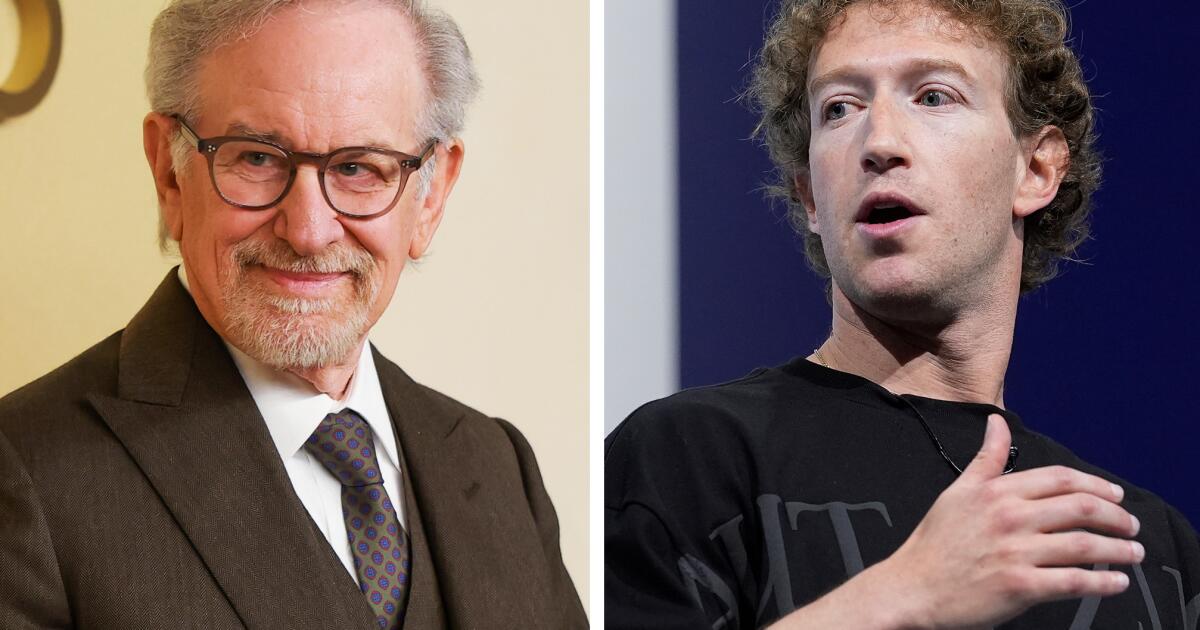

California, long a magnet for the wealthy and innovative, is facing a potential shift as high-profile figures like Steven Spielberg and Mark Zuckerberg consider or have made moves out of state. These departures coincide with a proposed wealth tax aimed at funding healthcare, sparking a debate about the future of the Golden State’s economic and social landscape.

A Taxing Proposition: The Core of the Debate

At the heart of the matter is a proposed 5% tax on the assets of California billionaires. Supporters, led by the Service Employees International Union-United Healthcare Workers West, argue the measure could generate roughly $100 billion annually for healthcare and education. Critics contend it will drive wealth and investment away, ultimately harming the state’s economy. The initiative requires nearly 875,000 signatures to qualify for the November ballot.

Spielberg and Zuckerberg: Following a Familiar Pattern?

Filmmaker Steven Spielberg has officially relocated to Manhattan, citing a desire to be closer to his children and grandchildren. Facebook founder Mark Zuckerberg is reportedly eyeing a $200-million waterfront mansion in Miami’s exclusive Indian Creek. While neither has explicitly linked their moves to the proposed tax, the timing has fueled speculation. It’s worth noting that Spielberg has owned homes on both coasts for decades.

Beyond the Headlines: A Broader Trend?

Spielberg and Zuckerberg aren’t alone. Venture capitalist David Sacks and PayPal co-founder Peter Thiel have similarly recently established offices outside of California, signaling a potential broader trend. This exodus echoes concerns about California’s high cost of living, complex business regulations, and increasingly progressive policies.

The State’s Reliance on Wealthy Taxpayers

California’s budget is heavily reliant on taxes paid by its wealthiest residents, particularly from capital gains and stock-based compensation. This concentration of revenue makes the state particularly vulnerable to shifts in wealth and investment. Governor Gavin Newsom’s 2026-27 budget summary highlights the difficulty of forecasting revenue due to this reliance.

Political Discord and the 2026 Governor’s Race

The proposed wealth tax has created a rift within the Democratic party, particularly as the 2026 governor’s race heats up. While Senator Bernie Sanders has publicly campaigned in support of the tax, Governor Newsom opposes it. This division underscores the complex political dynamics surrounding the issue.

The Role of Political Donations

Both Spielberg and Zuckerberg are significant political donors, contributing to candidates and causes across the political spectrum. Spielberg has historically favored Democratic candidates, while Zuckerberg’s donations have been more diverse, including contributions to both Democrats and Republicans.

FAQ: California’s Wealth Tax and the Exodus

Q: Will the wealth tax actually pass?

A: It’s currently unclear. The initiative needs to gather enough signatures to qualify for the November ballot, and then voters would need to approve it.

Q: What happens if a billionaire leaves California?

A: It could reduce state revenue, as California relies heavily on taxes from its wealthiest residents.

Q: Is this a novel phenomenon?

A: While the recent moves of high-profile individuals have drawn attention, concerns about California’s business climate and high taxes have been ongoing for years.

The situation remains fluid, and the long-term impact of these moves – and the proposed tax – on California’s economy and social fabric remains to be seen. The coming months will be crucial in determining whether the Golden State can retain its allure for the world’s wealthiest individuals.

Want to learn more? Explore our articles on California’s economic outlook and the impact of wealth taxes.