The Rising Conflict Between PBMs and Independent Pharmacies

Pharmacy Benefit Managers (PBMs) sit at the crossroads of drug manufacturers, insurers, and pharmacies. While they claim to lower costs through bulk negotiations, independent pharmacists argue that PBMs often push larger chains to the edge, reducing access for local communities.

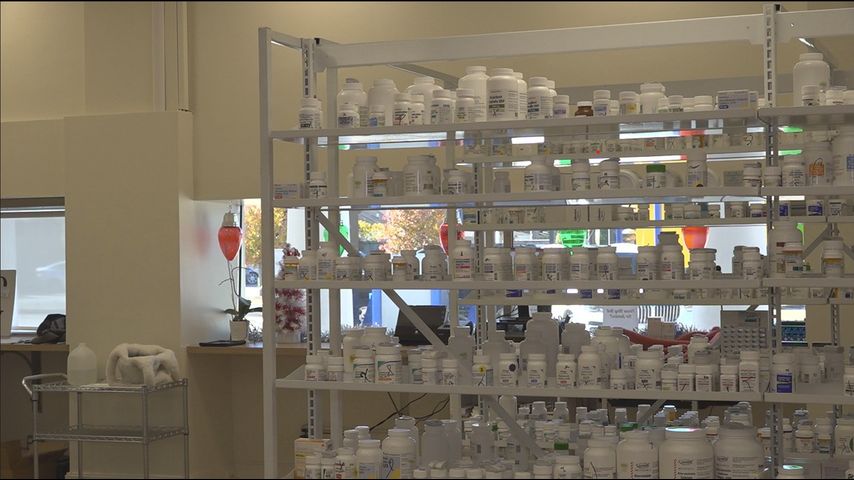

Why Independent Pharmacies Matter

Independent pharmacies like Prescriptions to Geaux provide personalized care that big‑box stores can’t match. Pharmacist T.J. Woodard says, “Our patients are our family, our friends, our neighbours.” Studies from the CDC show that patients who receive counseling from local pharmacists have a 15% higher medication adherence rate.

Legislative Trends Shaping the Future

States across the nation are revisiting laws that restrict PBMs from owning retail pharmacies. Louisiana’s recent lawsuits against CVS illustrate a broader push for “PBM transparency” legislation, a trend echoed in proposals from Minnesota, Ohio, and Washington.

Key elements of emerging bills include:

- Mandatory disclosure of rebate amounts.

- Ban on PBM ownership of pharmacies to curb conflict of interest.

- Price‑floor reporting to prevent “spread pricing”.

Potential Future Trends in the PBM Landscape

1. Shift Toward Direct Contracting

Health plans are increasingly contracting directly with manufacturers, bypassing PBMs to negotiate “pass‑through pricing.” A 2024 NEJM analysis found that direct contracts can shave up to 12% off list prices for generic drugs.

2. Rise of Pharmacy‑Centric Health Hubs

Independent pharmacies are evolving into full‑service health hubs, offering vaccinations, chronic‑disease monitoring, and tele‑pharmacy services. The American Pharmacists Association reports a 28% year‑over‑year increase in pharmacies providing COVID‑19 boosters and flu shots.

3. Increased Use of Technology and Data Analytics

Advanced analytics platforms enable small pharmacies to compete on pricing by aggregating purchasing power. Companies like RxRevolution are piloting “smart formulary” tools that match patients with the lowest‑cost options in real time.

4. Consumer‑Driven Transparency Tools

Apps such as GoodRx and Blink Health are empowering consumers to compare drug prices across pharmacies, putting pressure on PBMs to justify their fees. A 2023 survey by Pew Research Center found that 66% of respondents check price‑comparison apps before filling a prescription.

Real‑World Example: The CVS‑Louisiana Settlement

While the exact terms remain confidential, the settlement signals that large PBMs may need to adjust their strategy in markets with strong independent pharmacy advocacy. Industry insiders suggest the deal could include:

- Revised rebate structures favoring local pharmacies.

- Commitments to keep “network access” open for independent retailers.

- Increased reporting requirements to state regulators.

These concessions, if upheld, could set a precedent for future negotiations in other states.

FAQs

- What is a Pharmacy Benefit Manager (PBM)?

- A PBM acts as a middleman that negotiates drug prices and formulary placements on behalf of insurers and employers.

- How do PBMs affect the price I pay at the pharmacy?

- PBMs negotiate rebates that may lower wholesale prices, but they can also add “spread pricing” that inflates the cost you see at the counter.

- Can independent pharmacies compete with large chains?

- Yes, especially by offering personalized services, leveraging technology for price transparency, and participating in direct‑contracting models.

- Will new legislation ban PBMs from owning pharmacies?

- Several states are drafting bills to prevent such ownership, but federal action is still pending.

- How can I find the lowest price for my prescription?

- Use price‑comparison tools like GoodRx, check with local independent pharmacies, and ask your provider about generic alternatives.

Looking Ahead

The tug‑of‑war between PBMs and independent pharmacies is reshaping the pharmacy ecosystem. As transparency laws gain momentum and technology levels the playing field, patients stand to benefit from lower costs and more personalized care.

For deeper dives into pharmacy economics, check out our Understanding PBMs guide and the Success Stories of Independent Pharmacies series.

Have thoughts on the future of pharmacy benefit managers? Join the conversation in the comments below, share this article, and subscribe to our newsletter for weekly insights.