MicroStrategy’s Bitcoin Bet: A Sign of Institutional Maturation or Risky Overexposure?

MicroStrategy (MSTR), a business intelligence firm, continues to double down on its Bitcoin (BTC) strategy, recently purchasing an additional 13,600 BTC. This brings their total holdings to nearly 687,000 BTC. The market reacted positively, with the stock rising over 3% following the announcement and continuing to climb over 1% in pre-market trading. This latest purchase, the largest since the summer of 2025, raises crucial questions about the future of corporate Bitcoin adoption and the interplay between the stock’s performance and the underlying cryptocurrency.

The Price is Right: MicroStrategy’s Averaged Cost Basis

Currently, MicroStrategy’s average acquisition cost for Bitcoin is approximately $75,000. This provides a significant buffer against potential downturns, aligning closely with the April 2025 correction low – a period triggered by concerns surrounding potential tariffs. Despite a strengthening US dollar, Bitcoin has demonstrated resilience, stabilizing around $90,000 and quickly rebounding to $92,000 after a recent dip. Interestingly, demand for hard assets, including precious metals, has remained strong even with a robust dollar, a trend that could further benefit Bitcoin as a store of value.

Source: xStation5

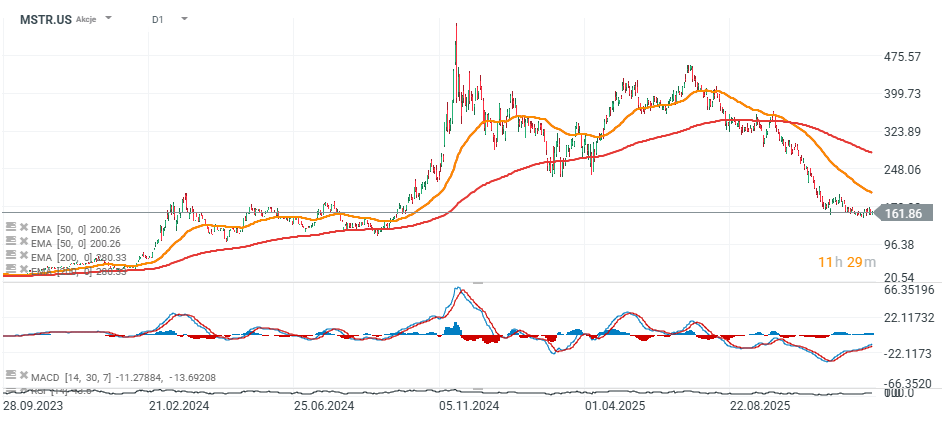

MSTR Stock: Decoupling or Still Tethered to Bitcoin?

MicroStrategy’s stock has experienced a substantial decline of around 70% from its peak, a pattern historically coinciding with significant Bitcoin bear markets. However, the landscape is evolving. The emergence of spot Bitcoin ETFs introduces competition, potentially reducing demand for MSTR as a proxy for Bitcoin exposure. Investors now have more direct avenues to gain exposure to BTC. Despite this, a renewed bull market in Bitcoin is likely to reignite interest in MSTR, particularly from investors seeking a publicly traded company with substantial Bitcoin holdings.

Technical indicators, such as the RSI and MACD, are showing signs of turning upwards. A breakout for Bitcoin above $95,000 could significantly accelerate the recovery of MSTR’s stock price. This suggests a continued, albeit potentially volatile, correlation between the two assets.

Source: xStation5

The Broader Implications: Corporate Bitcoin Adoption in 2026

MicroStrategy’s continued investment signals a growing acceptance of Bitcoin as a legitimate treasury reserve asset. While other companies have experimented with Bitcoin holdings, MicroStrategy’s commitment remains unparalleled. This strategy isn’t without risk, as demonstrated by the stock’s recent performance. However, it also positions the company to potentially benefit significantly from future Bitcoin appreciation.

The success (or failure) of MicroStrategy’s strategy will likely influence other corporations considering similar moves. Factors such as regulatory clarity, institutional adoption, and macroeconomic conditions will play a crucial role in determining the extent of corporate Bitcoin adoption in the coming years. We’re already seeing increased discussion around Bitcoin as a hedge against inflation and currency devaluation, particularly in countries facing economic instability. For example, El Salvador’s adoption of Bitcoin as legal tender, while controversial, has sparked debate and interest globally.

The rise of Bitcoin ETFs also introduces a new dynamic. These ETFs provide institutional investors with a regulated and accessible way to gain Bitcoin exposure, potentially lessening the need to directly hold the asset on their balance sheets. However, the limited supply of Bitcoin – capped at 21 million coins – continues to be a key driver of its long-term value proposition.

Pro Tip: Diversification is Key

While MicroStrategy’s strategy may appeal to Bitcoin enthusiasts, remember that diversification is crucial for any investment portfolio. Don’t put all your eggs in one basket, even if that basket is filled with Bitcoin.

Frequently Asked Questions (FAQ)

- What is MicroStrategy’s Bitcoin strategy? MicroStrategy is accumulating Bitcoin as a primary treasury reserve asset, believing it to be a store of value and a hedge against inflation.

- How does MSTR stock correlate with Bitcoin’s price? Historically, MSTR stock has shown a strong correlation with Bitcoin’s price, but the emergence of Bitcoin ETFs is introducing some decoupling.

- Is MicroStrategy a risky investment? Yes, MSTR is considered a high-risk investment due to its heavy reliance on Bitcoin’s performance and the volatility of the cryptocurrency market.

- What is the average cost basis of MicroStrategy’s Bitcoin holdings? Approximately $75,000 per BTC.

Did you know? MicroStrategy initially invested in Bitcoin in August 2020, marking a pivotal moment in corporate Bitcoin adoption.

Explore further insights into the cryptocurrency market and investment strategies on our Investment Insights page. Stay informed and make smart financial decisions.